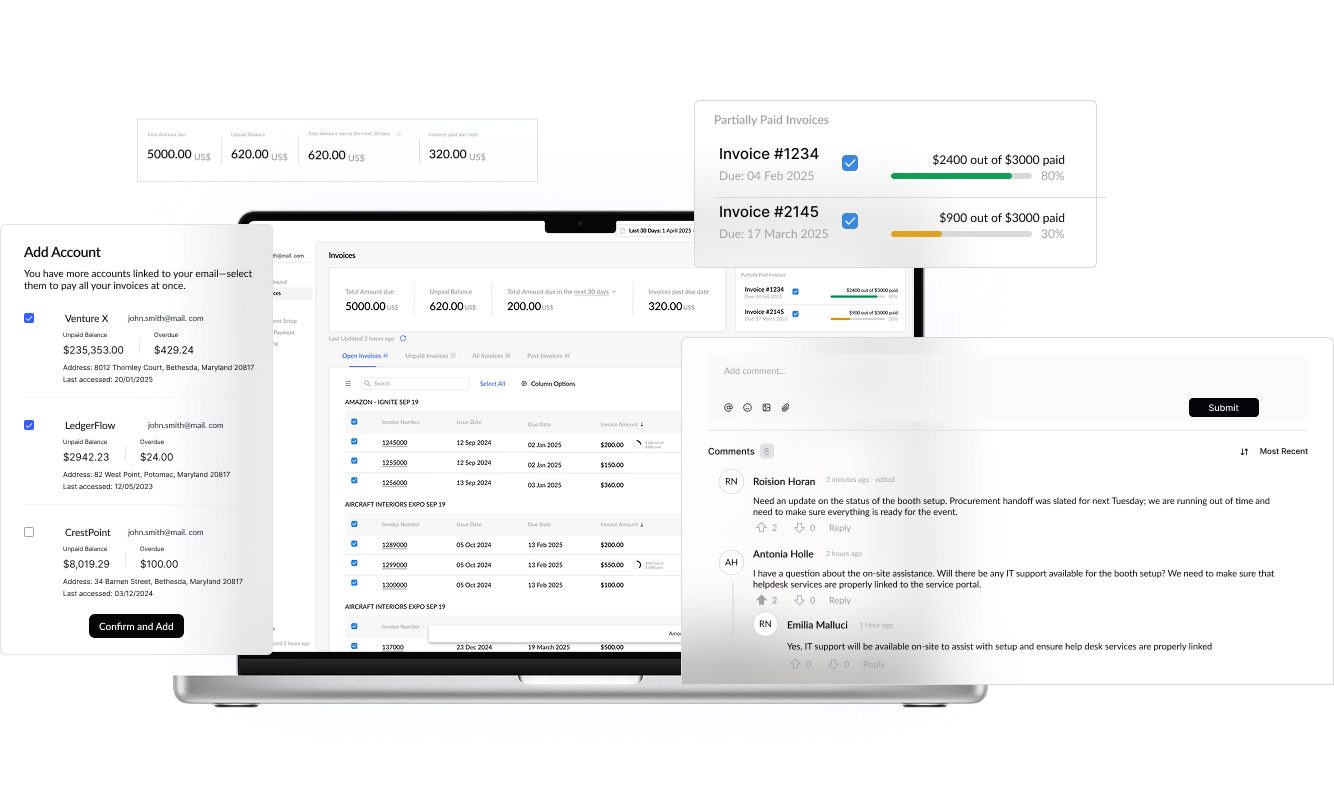

tilliX - Enterprise Experience & Self-Service Portal

tilliX is our comprehensive self-service portal platform that enables digital bill presentment, payment acceptance, and customer account management. Key features include:

- Digital bill presentment and eBill enrollment

- Self-service payment plan management

- Dispute resolution and case management

- Account information updates

- Payment history and transaction tracking

- Mobile-responsive white-label interface

- WCAG accessibility compliance

- Multi-language support